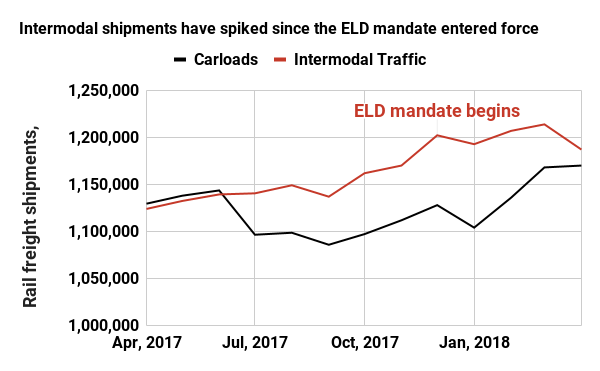

Shippers are used to converting truckloads to rail when rates go up. But this time around, volumes may never revert back.

Railroads continue to benefit from the trucking capacity crunch as shippers look to intermodal service to move their freight. While there have been previous cycles of highway-to-rail conversion and back again, industry experts think this time the switch may be more long term.

This time, trucking capacity began to tighten in mid-2017 after a string of severe weather disasters. The situation worsened as the economy gained momentum and the industry struggled with a shortage of more than 50,000 drivers, the Washington Post reported.

The implementation of the electronic logging device (ELD) mandate for truck drivers further reduced available capacity, as drivers are no longer able to run past the hours-of-service regulations. Industry estimates on the impact ranged from a 3% to 10% hit on trucking capacity, which along with the driver shortage and growing demand, has left cargo owners scrambling to move loads by rail instead of highways.

So far in this conversion cycle, total intermodal traffic grew 7.2% year-over-year in the first quarter of 2018, the strongest gain since second quarter 2014, according to an Intermodal Market Trends & Statistics report from the Intermodal Association of North America. Domestic containers increased 6.2%, international intermodal volumes shot up 7.0%, and trailers led overall growth at 14.5%.

Previous traffic conversion cycles were driven by high fuel prices, strikes and other factors that eventually were reversed, which led shippers to return to the lower rates and tighter delivery schedules that the trucking industry offers.

As ELDs create a new service environment…

However, that may not be the case this time.

The ELD mandate from the Federal Motor Carrier Safety Administration didn’t actually change the hours-of-service regulations for truck drivers. The goal was to stop drivers from falsifying paper logbooks to hide that they had driven more than the legally-allowed 11 hours in a 14-hour period before taking a required 10-hour break. With ELDs connected to the engine, tracking every movement, drivers must keep a careful watch on the clock.

With the ELD mandate in place, experts say some level of trucking capacity has permanently evaporated, as trucking companies are no longer able to operate in excess of the hours of service regulations.

“Previous traffic conversion cycles were driven by high fuel prices, strikes and other factors that eventually were reversed.” -Supply Chain Dive

“This is the first time we’ve gone through a cycle where we’ve had ELDs in place, meaning everyone has to follow the hours of service rules, so we’re seeing what happens when there’s just not enough capacity to meet all the demand,” Jim Filter, senior vice president and general manager of intermodal for Schneider told Supply Chain Dive. “I don’t think carriers will be able to drop their rates as they did in the past, so we won’t see those big swings where rates crashed and we converted back to over the road.”

When Schneider, the sixth-largest U.S. for-hire carrier, transitioned to ELDs in 2010, the company saw a 3% to 6% drop in productivity. It’s no wonder the capacity loss has taken some carriers by surprise.

“We knew that some companies weren’t running legally and when they switched over to ELDs the loss of productivity would be far greater than 3% to 6%,” Filter said. “You don’t have to pull a lot of capacity out of this industry before you start to see a major change.”

… intermodal rail is filling the service gap

Rail intermodal service is picking up the slack. It’s not just a matter of pricing but also capacity availability and reliability.

In Schneider’s case, shippers choose which mode will be used to account for scheduling as well as pricing. At this point, intermodal drayage capacity is not under as much pressure as over-the-road movements, so reliability is typically better, Filter said.

“An over-the-road shipment might take three days and intermodal is five days, but if it takes two days to find a truck you haven’t gained anything and introduced unreliability into your schedule and pricing,” he said.

As railroads benefit from the traffic conversion to intermodal, they’re adjusting rates and continuing infrastructure investments.

For the first quarter, BNSF reported a 6% rise in domestic and international intermodal volumes, which the company attributed to economic growth and tight truck capacity.

Railroads are reporting higher monthly averages in 2018 than they recorded in all of 2016. Credit: Bureau of Transportation Statistics

Kansas City Southern reported an 8% increase in carloads in the first quarter of 2018 compared to the previous year.

Collectively, railroads have spent billions of dollars improving their privately-owned infrastructure, and much of the investment has targeted intermodal facilities. Investment strategies are typically long-term, and most were planned before the current capacity crunch.

Norfolk Southern (NS) is gearing up for the surge in traffic, as intermodal volumes were up 9% through late May, Alan Shaw, executive vice president and chief marketing officer, told the Wolfe Global Transport Conference.

NS is stepping up train crew hiring and locomotive leasing to improve overall service levels. Shaw said the company is adding 700 train and engine employees and leasing 90 locomotives to improve velocity.

As part of its Precision Scheduled Railroading initiative, CSX is building 13% longer trains to move in point-to-point service for fewer delays, Dean Piacente, vice president of intermodal sales and marketing, said at an investor conference. The company’s investment plan includes adding 600,000 units of capacity in intermodal terminals.

That doesn’t mean railroads won’t take advantage of the conversion trend.

NS announced a rate hike of up to 15% on containers in the EMP domestic interline container pool it shares with Union Pacific. The increase will affect only a small portion of the company’s non-contract domestic container traffic, Shaw said.

NS is also revisiting long-term intermodal contracts to increase pricing in the next few years.

“As we work through the bid season, it feels like the market will support improved pricing through 2019,” Shaw said.

Source: Supply Chain Dive