Introduction

The pharmaceutical cold chain logistics market is growing at a rapid clip but it is also undergoing changes at an equal clip. Globalization, increasing regulations and the sheer growth of temperature controlled goods are spurring these changes.

In partnership with the 14th Annual Cold Chain GDP & Temperature Management Logistics Global Forum, research and consulting firm, Logistics Trends & Insights LLC hosted a Twitter chat as well as a series of specialized surveys and additional research are presented in this white paper. Special thanks to Logistics Trends Inc. and MD Logistics for their insights and participation in the Twitter chat.

The Pharmaceutical Cold Chain Logistics Market

“Cold Chain logistics ensures product integrity” – Emilie Gerbers, Business Development Manager, MD Logistics

“29% of all new drugs require temperature control.” – Jim Bisaha, CEO of Logistics Trends Inc.

According to Pharmaceutical Commerce’s annual Biopharma Cold Chain Sourcebook, the global pharmaceutical industry is huge, estimated at over $1 trillion. Thanks to changes in demographics and increasing demand in emerging markets, the industry is expected to grow even more, 41%, by 2020. Within the industry, non-cold chain logistics is anticipated to grow 34% by 2020; but, due to the growth of biologically-based products, pharmaceutical cold chain logistics will likely grow at a faster rate, 65%, by 2020.

Where’s the Growth?

Interesting enough, while emerging markets, particularly in Asia, are becoming a larger market for pharmaceuticals in general, Europe offers the biggest opportunities in cold chain logistics. According to one of our specialized social media surveys, Europe barely surpassed Asia as the region with the biggest opportunity. Government trade data corroborated the survey results. In terms of value of perishable goods transported, intra-Europe is the largest market with 38% of the global share followed by intra-APAC with 12.9% and intra-North America with 6.5%. Within the intra-Europe market for perishables, the Netherlands to Germany is the largest country pairing. This could be related to the strong capabilities in and around the surrounding area of Amsterdam’s Schiphol International Airport.

Schiphol’s focus on pharmaceuticals and other perishables dates back several years when the airport and business groups came together to promote and create perishable corridors and trade lanes between the airport and other important markets. Indeed, the airport’s location in relationship to road, rail and water links creates a strong multi-modal hub and has attracted many logistics and transportation providers to this area. Among the providers with specific cold chain capabilities in and near the airport are DHL, Kuehne + Nagel, Panalpina, Yusen Logistics, MNX, and UPS.

Cold Chain Logistics Pain Points

There are quite a few pain points within cold chain logistics. Managing cold chain logistics is a specialized service. While many logistics providers and freight forwarders say they offer cold chain logistics services, customers need to do their homework.

Our Twitter survey indicated regulations were among the biggest pain points. Jim Basha of Logistics Trends Inc. noted the need to understand the regulatory environment. Emilie Gerbers of MD Logistics agreed that the regulatory environment was challenging but also indicated the need to maintain consistent temperature within the supply chain was equally challenging.

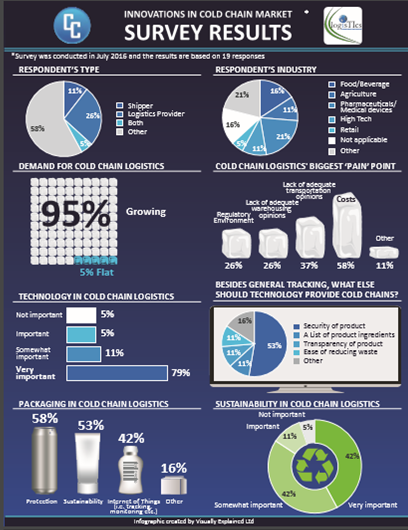

Our survey agreed with both Ms. Gerbers and Mr. Basha but the majority of survey respondents said costs including transportation, warehousing and investments in technology were the biggest pain points; however, Ms. Gerbers suggested temperature controlled containers offer significant ways to reduce transportation costs and allow for more volume.

Technology

79% of survey respondents indicated that technology is very important in cold chain logistics. Besides general tracking, survey respondents indicated technology has been beneficial towards product security. In addition, technology should be used to provide product ingredients, transparency of the product as well as reducing waste. In addition, some survey respondents highlighted the importance of atmosphere and temperature monitoring including GPS and time alarms for refrigerants.

Sensors are playing an increasingly important role in the cold chain. Besides tracking cargo and parcels, sensors also monitor temperature and humidity levels and combined with analytics, supply chain partners receive valuable information in which actionable steps such as a parcel intercept or an adjustment in temperature within a container can be taken. In addition, the sensor can determine if re-icing cold chain shipments is needed or can be used to inspect and repackage damaged goods or help in pursuit of stolen products.

While we are familiar with such providers as DHL, FedEx and Kuehne + Nagel as providing specialized pharmaceutical supply chain services, there are also a growing number of companies that provide specific monitoring and analysis. One such company is CargoSense which is a technology startup company based in Washington DC focused on the transportation monitoring of pharmaceuticals and other perishables. CargoSense provides what it calls “Black Box” insight for individual shipments. Not only is temperature monitored but also humidity, light and over twenty sensor points.

Working with Toshiba Semiconductor, CargoSense utilizes rechargeable sensors that can also be rolled on top and be used with other sensors that shippers may require. The sensors in turn allow the company to collect and analyze all the shipment data from origin to destination, pull out events and share the analysis with all players involved in a particular shipment, thus, providing the complete story of a shipment. CargoSense and Toshiba Semiconductor sensors are used not only on airplanes but also ocean vessels and other modes of transportation.

As an example of the service it provides, CargoSense has been able to verify that 90% of the temperature-controlled air freight problems happen on the tarmac. This is valuable for all supply chain partners involved in a shipment and as a result will be able to focus on the part of the chain to make sure it is secure within the right temperature range.

Packaging

“Packaging is extremely important. The product must be kept at the right temperature.” – Jim Basha, Logistics Trends Inc.

“Packaging is key to domestic & international shipping. Validated shippers are a must for patient safety.” – Emilie Gerbers, MD Logistics

Indeed, survey respondents were unanimous in the importance of packaging. 58% of respondents indicated that packaging’s major role was for protecting the products while 53% noted the importance of sustainability. Other responses included tracking and monitoring of products.

Logistics providers such as FedEx and DHL offer specialized package services including UPS’ Temperature True Packaging which extends to consultation, package procurement and off-the-shelf specially designed packaging lines available exclusively to UPS customers.

The type of packaging depends on the customer’s requirements. Active packaging helps to control the temperature of a drug using a variety of methods including via electricity and/or battery.

Active packaging often takes the form of leased containers such as those from C-Safe and Envirotainer. Both of these companies offer a range of containers that are able to manage temperature ranges. Both companies also have established a global network which one can utilize to drop off and pick up.

However, active packaging can be viewed as an expensive service for some and as such, passive packaging maybe an option. In particular, if strict temperature performance is not a requirement. Cryopak and ThermoSafe are among several companies designing innovative passive packaging such as re-usable gel packs and vacuum insulate panels.

Choosing Your Cold Chain Logistics Provider

In order of our specialized surveys, we asked the social media community if they would use a freight forwarder for cold chain logistics. Only 30% of respondents indicated they would use a freight forwarder but half of the respondents reported they would use a niche provider instead. In an interview with online publication, The Loadstar, Kuehne + Nagel’s senior vice president for global air logistics products and services said, “There is a lack of skills, training and standards throughout cool-chain logistics, with no SOPs or working instructions in place overall.” Perhaps this is the hesitancy in choosing a freight forwarder or logistics provider. For niche providers, such as Marken, Life Science Logistics, Shine Express and Hanson Logistics, these providers focus solely on cold chain logistics. Services include cold chain warehousing and transportation solutions along with specialized services such as kitting and compiling clinical trail packages for delivery.

But don’t give up on logistics providers and freight forwarders. New services are continuously being announced. For example, DHL has expanded its Thermonet solution to include not only air but also ocean freight transportation while FedEx opened an expanded cold chain distribution center in Memphis and UPS SCS has expanded its clinical trial solutions.

As noted earlier in this paper, customers need to do their homework and fully vet each potential partner.

The 5-10 Year Outlook for Pharmaceutical Cold Chain Logistics

The outlook for pharmaceutical cold chain logistics is a positive one. The ability to think out of the box is necessary as the cold supply chain expands throughout the world. Technology is playing a growing role and emerging technologies such as drones and 3D-printing continue to capture the imagination of the industry as the number of trials for each increase.

Check out some of the comments from panelists and survey respondents for their thoughts on the outlook:

“The industry needs to be forward thinking & committed to continue improvements.” – Emilie Gerbers, MD Logistics

“A huge opportunity in the 3rd world continues where currently over 50% of vaccines needs to be scrapped due to spoilage.” – Jim Bisaha, Logistics Trends Inc.

“Large increase in technology monitoring and more options for intervention.” -Survey respondent

“I believe the demand for cold chain will grow dramatically, with new players entering the market from both a carrier and technology perspective.” – Survey Respondent

“Increased awareness, tracking within the telematics system and compliance as well as sustainable attributes to support EPA.” – Survey Respondent

Additional Information

A transcript of the Twitter Chat, “Innovation in Cold Chain Logistics” can be found at: https://storify.com/cmroberson06/innovations-in-cold-chain-logistics

A big thanks to our panelists who took time from their busy schedules to provide valuable insights. Please visit their websites to learn more about their special offerings:

Logistics Trends Inc. – https://logisticstrends.com/

MD Logistics – https://www.mdlogistics.com/

A special thanks to our sponsor, the 14th Annual Cold Chain GDP & Temperature Management Logistics Global Forum, September 26-30. For more information on the conference, please visit https://www.coldchainglobalforum.com/

Source: Logistics Trends & Insights, LLC